Brief Information about GST Invoice Templates?

A registered vendor will provide a customer with a GST (Goods and Services Tax) invoice. It is used to track and log the selling of products or services as well as to show how much tax was charged on the deal.

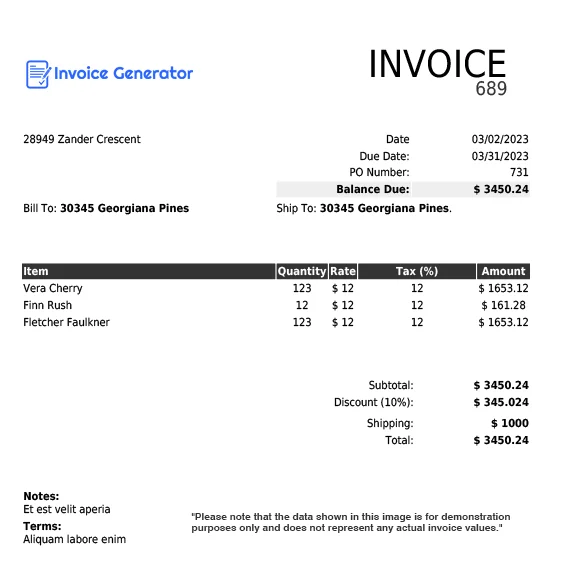

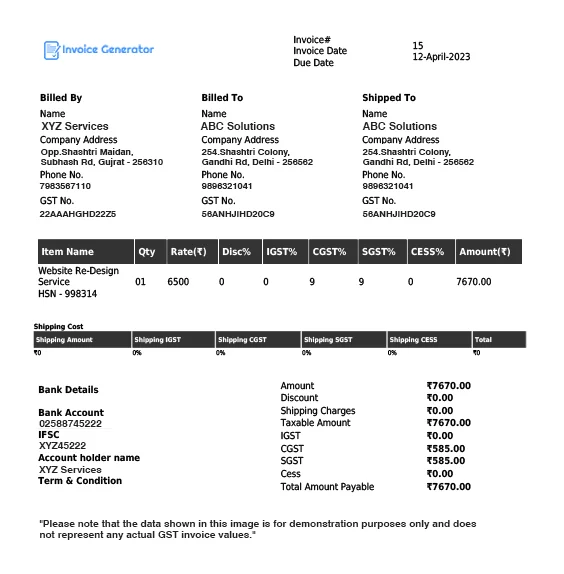

The GST invoice must include a number of mandatory information, such as the supplier's and customer's names and addresses, their respective GSTINs (Goods and Services Tax Identification Numbers), a special invoice number, the invoice date, an account of the products or services supplied, the quantity of goods or services, the price of goods or services, and the GST rates and amounts that are applicable.

GST invoices must be issued for all transactions made by all enrolled GST users; failing to do so may result in penalties and fines. Additionally, since GST invoices are necessary for getting input tax credit, companies must maintain them properly and keep records of them. (ITC).

What are the Essential Elements of a GST Bill Format or Templates?

Paying close attention to detail is essential when producing GST bills. Failure to include all essential components in your invoice style can result in exorbitant errors later on. Make sure the following crucial components are included in your invoice structure to prevent these problems and guarantee conformance with GST regulations:

- An accurate and succinct bill title

- A bill number that is simple to recognize

- The issuance date and the payment deadline

- Detailed information about the provider

- Detailed information about the receiver that is accurate

- The recipient's and the supplier's GSTIN

- Clearly identifying the source of the product

- Shipping information, if relevant

- A thorough listing of the products or services offered, complete with names and details

- The appropriate GST amount, such as 12%, 18%, or 5%.

- Item prices and numbers

- The proper GST rates and categories (CGST, SGST, and IGST)

- Any relevant reductions or modifications

- Every applicable clause that governs the deal

- The supplier's autograph, which adds legitimacy and trustworthiness.

You can reduce the possibility of errors, ensure regulatory compliance, and uphold a credible and expert image with your customers and partners by including all of these components in your GST invoice style.